How to Accept ACH Direct Debit (U.S. Bank Accounts) Payments

In This Document

Direct debit payments on the Automated Clearing House (ACH), or ACH debits, allow businesses to collect funds from customers in the US who provide their bank account details and authorize businesses to debit them.

| Payment Method Type | Bank debit |

| Relevant Payer Geography | US |

| Presentment Currency | USD |

| Country Availability | United States |

| Recurring Payments | Yes |

| Refunds | Yes |

| Disputes | Yes |

| Payment Completion | 2 – 5 business days |

| Payment Amount | Credit Card Fee | ACH Direct Debit Fee |

|---|---|---|

| $100 | $3.20 | $0.80 + $1.50 verification fee |

| $1,000 | $29.30 | $5.00 + $1.50 verification fee |

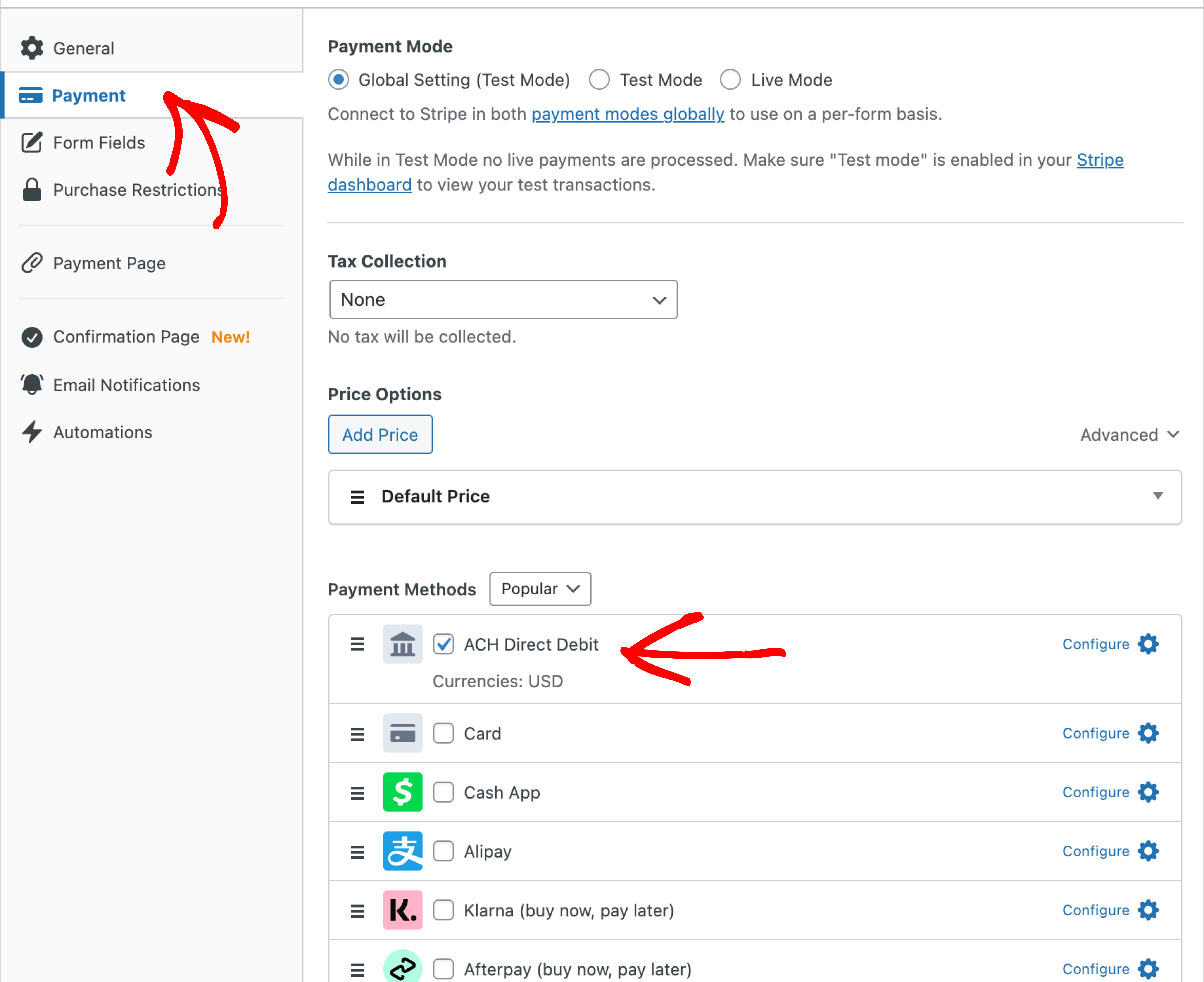

Enable ACH Debit

To accept ACH Direct Debit payments, visit the Payment tab in the payment form builder, and enable ACH Direct Debit.

Microdeposits

You can also allow your customers to verify their bank account information using microdeposits, meaning almost any U.S.-based banking institution can be utilized.

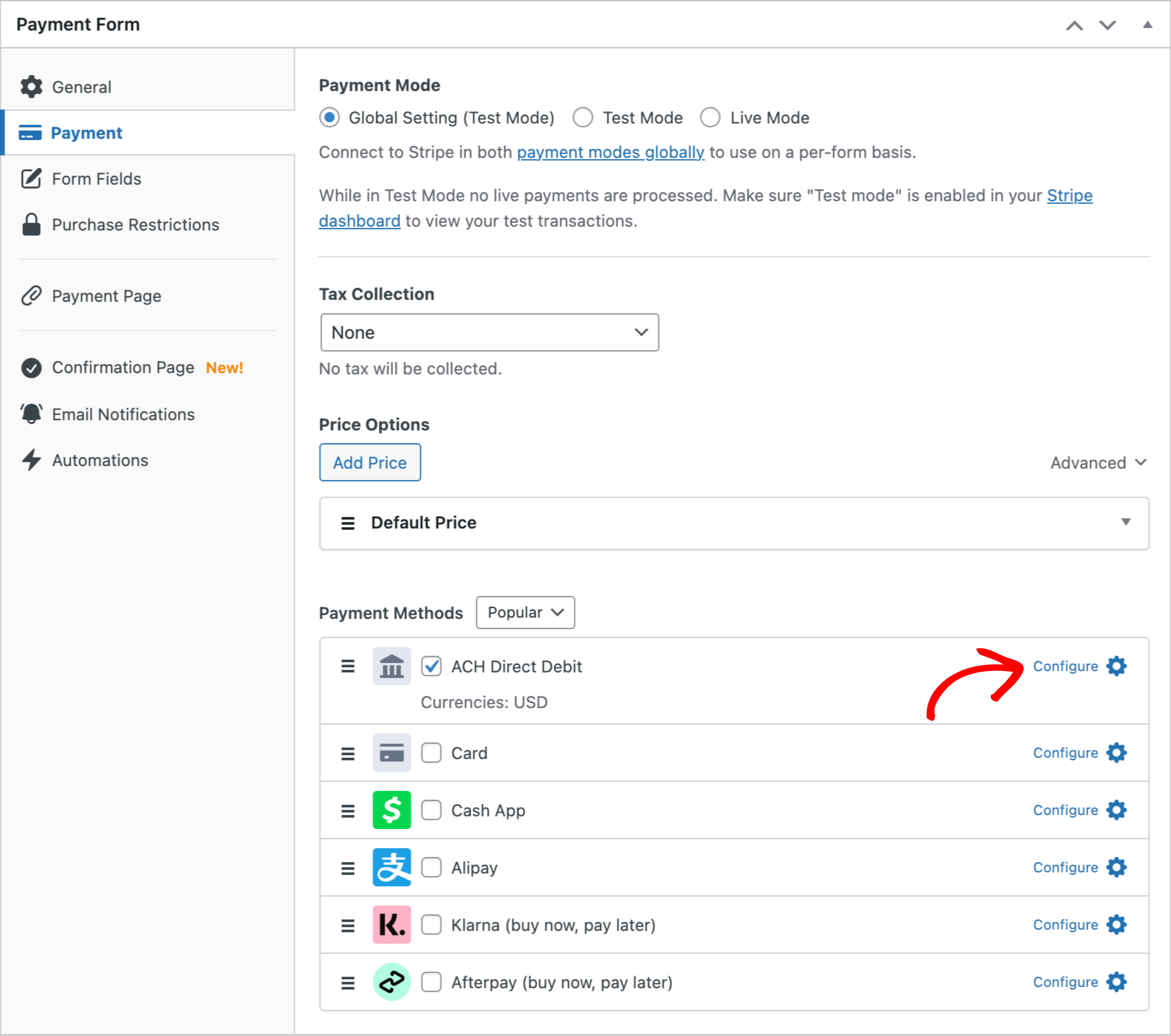

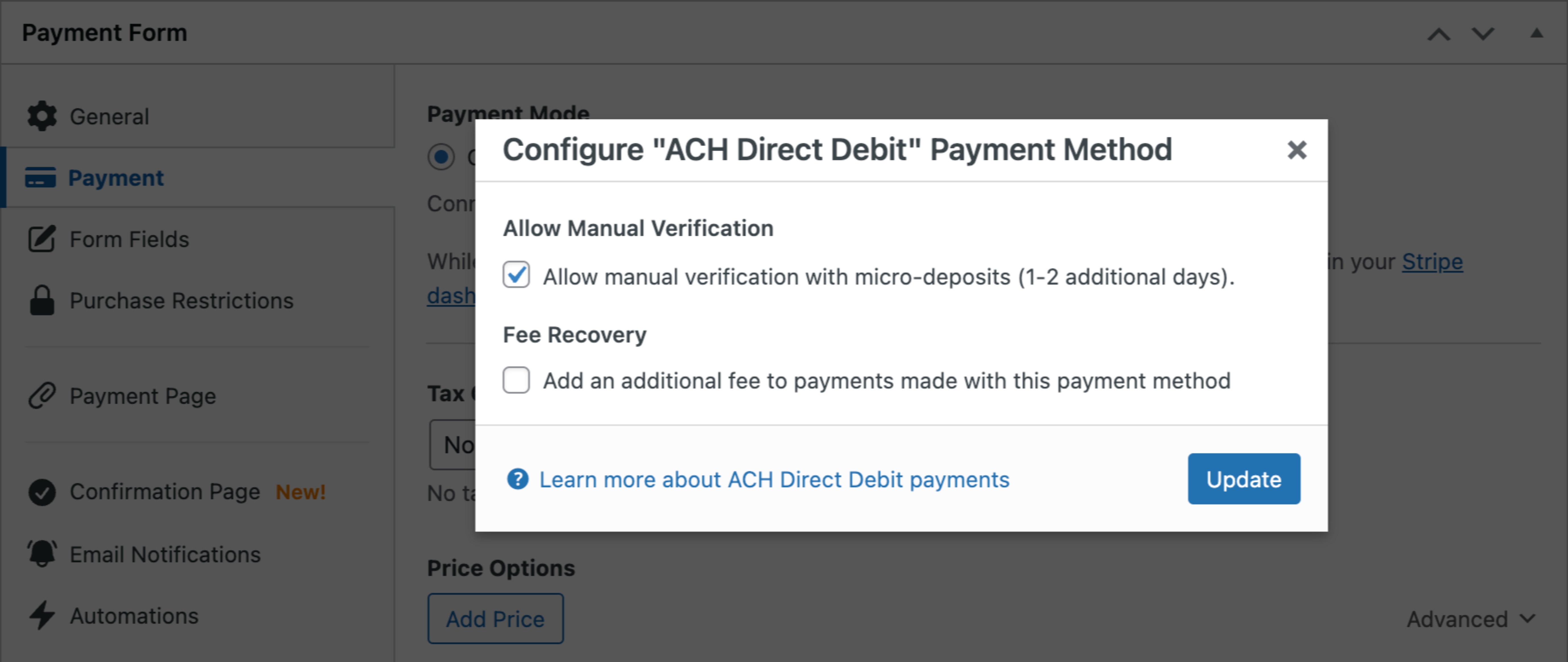

To enable microdeposits, visit the Payment tab in the payment form builder, and click the Configure icon in the ACH Direct Debit method area.

This will open a modal window where you can enable Allow Manual Verification.

Notes About Using Microdeposits

In Test Mode

- The microdeposit email is sent immediately when using an email formatted like

{any-prefix}+test_email@{any_domain}( i.e[email protected]) when testing. This will allow you to receive the micro-deposits email to do a complete test. - There is a 60-second processing time

In Live Mode

- The microdeposit email is sent in 1-2 days

- The standard ACH processing applies which is 2-5 days processing time after the microdeposit email is verified.

- There is no way to use a test email to override this standard functionality.

More Information

For eligible businesses, funds can be available within 2 business days from when the payment is processed. Otherwise, funds can be available within 4 business days. For more details and information on eligibility:

Troubleshooting

Your account currently does not support bank account payment amounts greater than $6,000.00

Stripe places an initial $6,000 ACH Debit transfer limit on new accounts. View Stripe’s support article for more information.

Still have questions? We’re here to help!

Last Modified: