How to Accept Afterpay/Clearpay Buy Now, Pay Later Payments

Afterpay (also known as Clearpay in the UK) offers customers more payment flexibility with no credit checks, no upfront fees, and no interest for on-time payments. Afterpay has more than 13M global customers and works with 75,000 brands and retailers.

Afterpay allows customers to get what they want today and pay for purchases over time. During checkout, customers choose Afterpay as their payment method and spread the cost across 4 interest-free payments over the next 6 weeks, with the first payment due at the time of purchase. Afterpay is free for customers who pay on time.

Businesses offering Afterpay receive the full payment upfront and are protected against fraud and customer payment risk.

For more information, please visit Stripe’s Afterpay/Clearpay buy now, pay later documentation.

| Payment Method Type | Buy now, pay later |

| Relevant Payer Geography | Australia, Canada, France, Italy, New Zealand, Spain, United Kingdom, United States |

| Presentment Currency | AUD, CAD, EUR, GBP, NZD, USD |

| Country Availability | Australia, Canada, France, Italy, New Zealand, Spain, United Kingdom, United States |

| Recurring Payments | No |

| Refunds | Yes |

| Disputes | No |

| Payment Completion | Immediate |

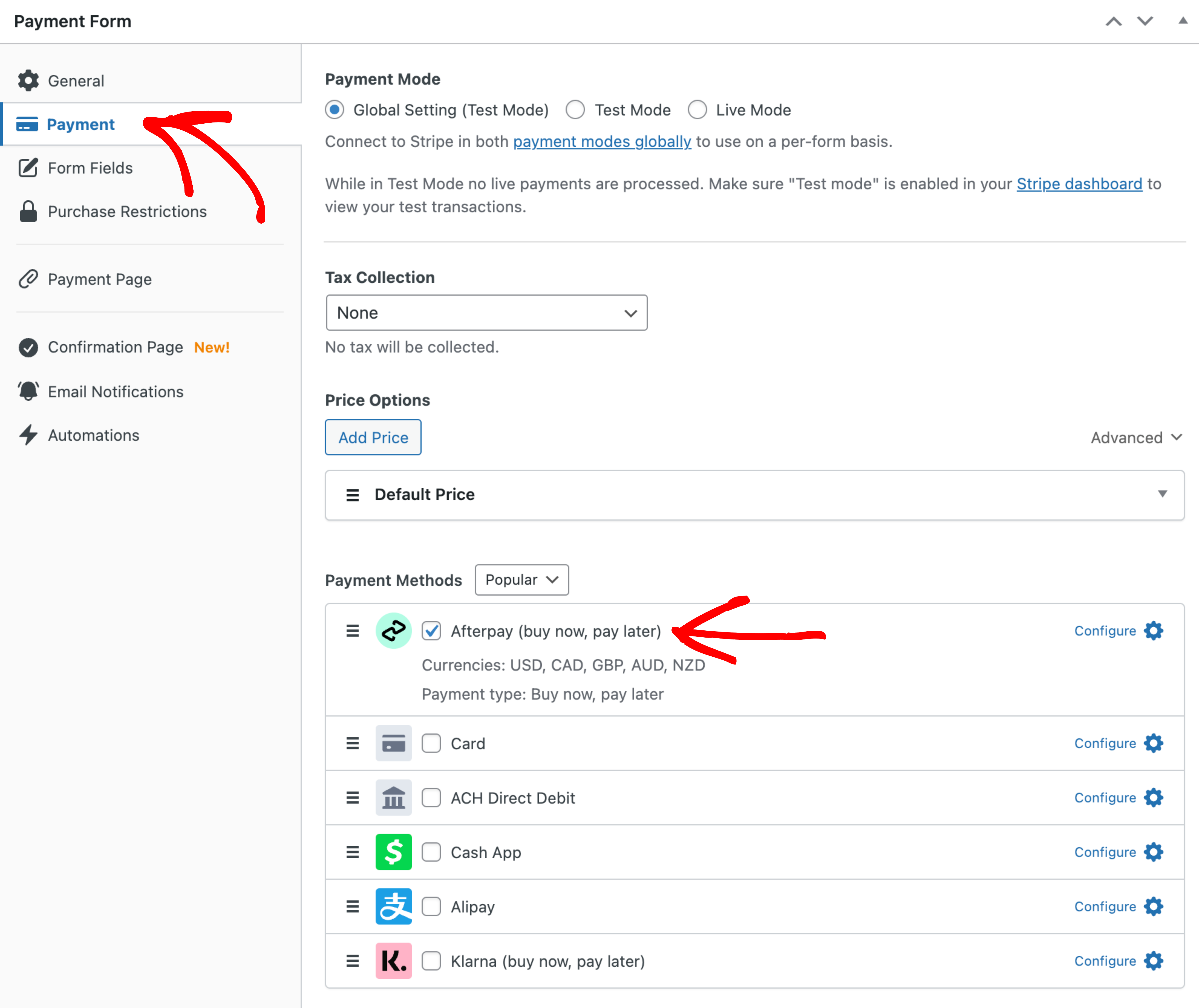

Enable Afterpay/Clearpay

To accept Afterpay/Clearpay payments, visit the Payment tab in the payment form builder, and enable Afterpay/Clearpay (buy now, pay later).

Still have questions? We’re here to help!

Last Modified: