How to Accept SEPA Direct Debit Payments

The Single Euro Payments Area (SEPA) is an initiative of the European Union to simplify payments within and across member countries. They established and enforced banking standards to allow for the direct debiting of every Euro-denominated bank account within the SEPA region, facilitating more than 20 billion transactions every year.

In order to debit an account, you must collect your customer’s name and bank account number in IBAN format. As part of the payment confirmation, customers must accept a mandate that authorizes you to debit the account.

| Payment Method Type | Bank Debit |

| Relevant Payer Geography | Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom |

| Presentment Currency | EUR |

| Country Availability | Australia, Austria, Belgium, Bulgaria, Canada, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, Latvia, Lithuania, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, United States |

| Recurring Payments | Yes |

| Refunds | Yes |

| Disputes | Yes |

| Payment Completion | 6 business days |

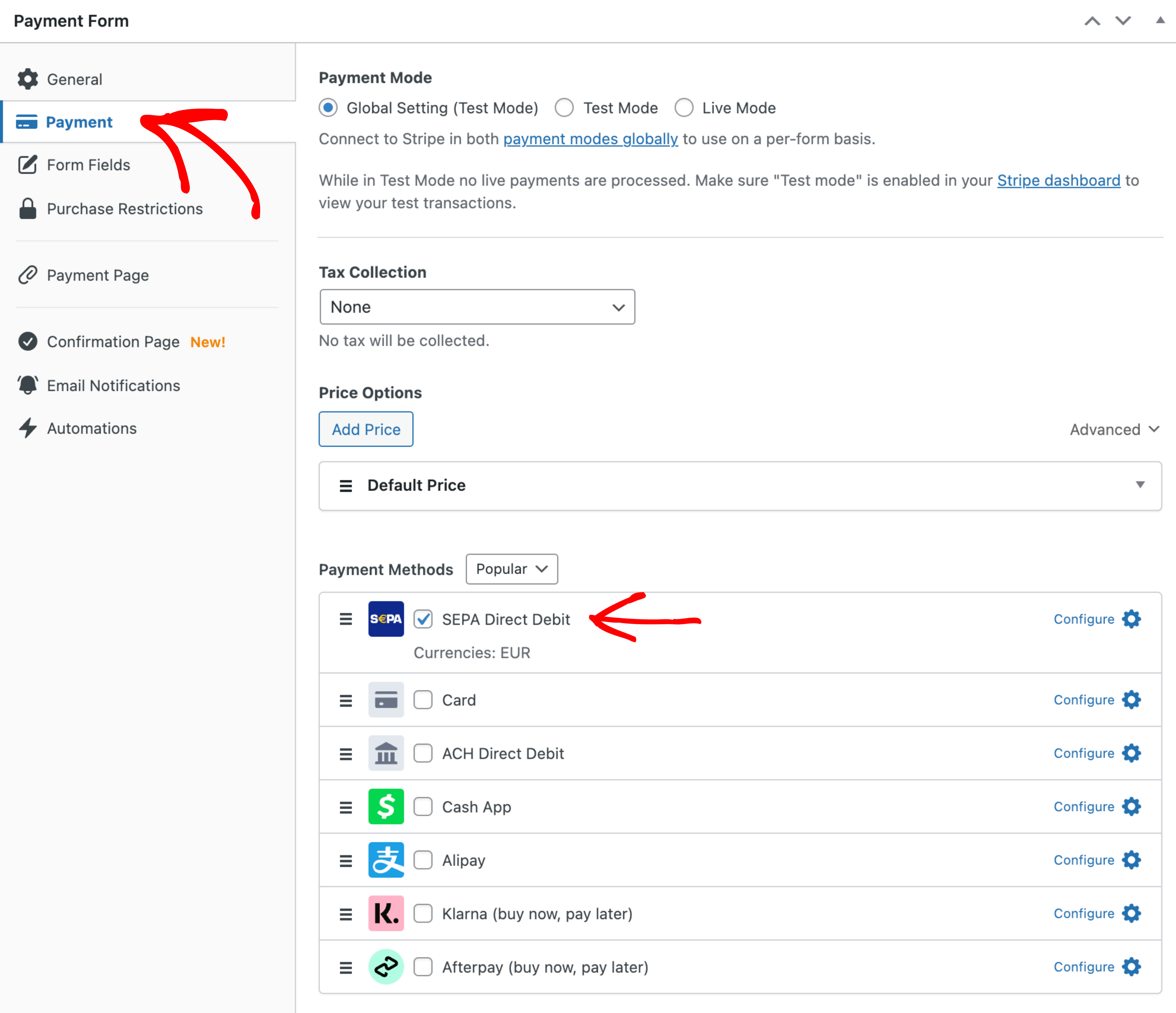

Enable SEPA Direct Debit

To accept SEPA Direct Debit payments, visit the Payment tab in the payment form builder, and enable SEPA Direct Debit.

Still have questions? We’re here to help!

Last Modified: